October 2, 2025

RED FM News Desk

As political debates over housing affordability continue in Parliament, Canada’s fiscal watchdog says the affordability gap has significantly narrowed nationwide—though the situation varies widely across the country.

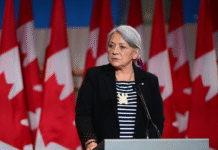

In a report released Thursday, Interim Parliamentary Budget Officer Jason Jacques revealed that the gap between average home prices and what the typical Canadian household can afford dropped from 80% in September 2023 to 34% in August 2025.

The PBO attributes this progress to falling borrowing costs, rising wages, and moderating home prices. After reaching record highs in 2022, home prices have since declined in many areas, following the Bank of Canada’s decision to raise interest rates sharply. With the central bank’s policy rate now at 2.5% after several cuts, mortgage costs have become more manageable.

The report noted that Canada’s priciest markets—such as Toronto and Hamilton—have seen the greatest gains in affordability over the past three years. However, even with these improvements, home prices in those cities remain well above what is considered affordable.

Halifax now holds the widest affordability gap at 74%, while Edmonton fares best among major cities with a gap of just 4%.

Conversely, affordability has worsened in Calgary, Montreal, and Québec, though the PBO emphasized that mortgage carrying costs in those markets remain relatively low compared to national standards.

The report also examined mortgage debt service ratios, which measure the portion of income households devote to mortgage payments. It found that affordability based on these ratios has largely returned to 2019 levels in the first half of 2025.

While improvements were noted in cities like Toronto, Vancouver, and Victoria, the PBO cautioned that households in those high-cost regions remain more financially vulnerable than in other parts of the country.