December 5, 2025

RED FM News Desk

Business groups in Calgary say the newly approved city budget is both disappointing and costly, arguing it will add pressure on local companies already dealing with a difficult economic climate.

Council managed to reduce the overall property tax increase that had been proposed, but did so partly by scrapping a planned tax shift from non-residential to residential properties. That move drew criticism from business advocates who had hoped the shift would continue.

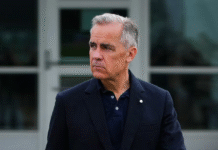

“We’re disappointed. We would have liked to see city council continue with what had been previously approved in the prior budget,” said Deborah Yedlin, president of the Calgary Chamber of Commerce. “Now we feel like this introduces a new element of uncertainty for the business community.”

Before council’s lengthy budget adjustment session, the combined property tax increase was projected at 3.6 per cent, with single-family homeowners potentially facing hikes of up to 5.8 per cent. Removing the tax shift lowered residential increases by about two percentage points.

But business groups say that relief comes at their expense.

“Definitely disappointed to see council cancel the two per cent planned property tax shift. Businesses were really looking forward to this,” said Kayode Southwood with the Canadian Federation of Independent Business.

“It’s going to create increased costs for businesses in the new year, and it’s really not something small businesses need to deal with right now, given the many other external challenges they’re facing,” he added.

On Wednesday, council ultimately approved a combined property tax increase of 1.6 per cent for 2026, applied equally to both homes and businesses.