December 4, 2025

RED FM News Desk

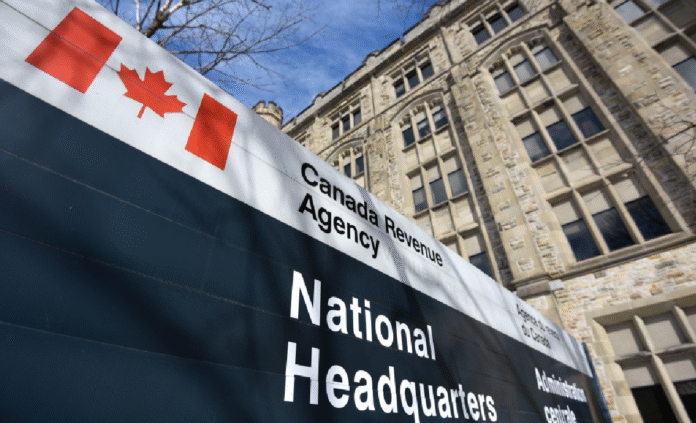

The Canada Revenue Agency is cautioning Canadians about “aggressive tax schemes” involving so-called critical illness insurance arrangements that are marketed as a way to avoid taxes.

In a statement Thursday, the CRA said these schemes rely on complex transactions, including borrowing money to pay for insurance, and can mislead taxpayers about their legality.

The agency noted that many of the schemes use limited-recourse loans, where lenders can recover funds only from specific assets, usually the insurance policy itself. If a borrower defaults, the lender cannot pursue other assets.

The CRA has previously warned about similar arrangements tied to Offshore Disability Insurance Plans and Offshore Leveraged Insured Annuities.

The agency said these setups are problematic because they appear to be legitimate insurance products but are actually structured to let shareholders withdraw money from their companies without paying taxes.

Such schemes are often promoted by groups of companies or individuals operating inside or outside Canada, the CRA added.