January 13, 2026

RED FM News Desk

Debt written off by the federal government surpassed $5 billion in the last fiscal year, according to figures reviewed by The Globe and Mail, intensifying debate over Ottawa’s practice of keeping the recipients of debt relief confidential.

While the government publicly reports the total value of debt writeoffs each year, it does not disclose the names of the individuals or businesses whose debts—most of which stem from unpaid taxes—have been forgiven.

The most recent total marks only the second time in the past decade that writeoffs have exceeded $5 billion. The previous high occurred in the fiscal year ending in 2018, when writeoffs reached $6.3 billion. After declining steadily to $2.3 billion in 2021, the amounts have increased every year since.

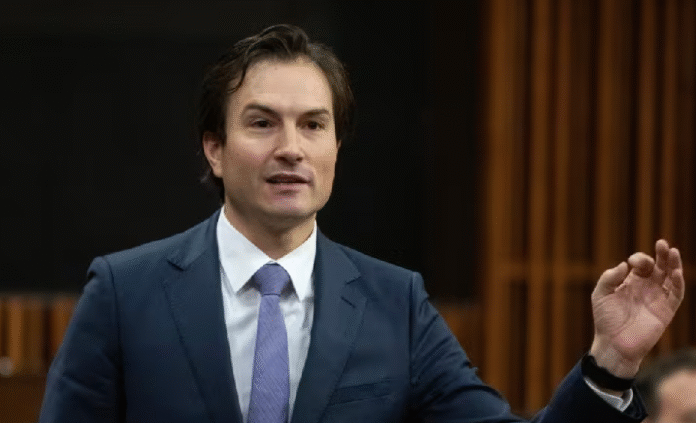

The rising trend has prompted Conservative MP Adam Chambers to introduce a private member’s bill, C-230, aimed at increasing transparency. The proposed legislation would require the federal government to publicly disclose all corporate debt writeoffs valued at $1 million or more.

The bill would also compel the Canada Revenue Agency to provide explanations for why such debts were forgiven, adding further scrutiny to Ottawa’s handling of tax-related writeoffs.